The 25+ Facts About The Basic Arbitrage Pricing Theory Model Of Two Factors! When implemented correctly, it is the practice of being able to take a positive and.

The Basic Arbitrage Pricing Theory Model Of Two Factors | Sharpe, a simplified model of portfolio analysis management science, vol. Apt was first created by stephen ross in 1976 to examine the influence of. Arbitrage pricing theory gur huberman and zhenyu wang federal reserve bank of new york staff reports, no. Describe the inputs (including factor betas) to a in the previous reading, we discussed the capital asset pricing model (capm). Stipulates that equivalent securities or bundles of securities must sell at.

Arbitrage pricing theory gur huberman and zhenyu wang federal reserve bank of new york staff reports, no. This theory was created in 1976 by the economist. Explain the arbitrage pricing theory (apt), describe its assumptions, and compare the apt to the capm. That is according to arbitrage if there are two assets which have same risk, theoretically their apt also holds that the correct price of an asset can be determined using the apt model derived expected rate. In finance, arbitrage pricing theory (apt) is a general theory of asset pricing that holds that the expected return of a financial asset can be modeled as a linear function of various factors or theoretical market indices.

2 the arbitrage pricing theory was first developed by ross (1976), and let us illustrate. 1 the arbitrage theory of capital asset. The basic idea of the capital asset pricing theory is that there is a positive relation between 1 william f. Arbitrage pricing theory (apt) is an equilibrium model of security prices, as is the capital asset pricing model (capm). Apt assumes that security returns are generated by a factor model but does not identify the factors. Arbitrage pricing theory, often referred to as apt, was developed in the 1970s by stephen ross. When implemented correctly, it is the practice of being able to take a positive and. The general idea behind apt is that two things can explain the expected return on a financial asset: Arbitrage pricing theory (apt) acknowledges that the return on the market portfolio may not be the only potential source of systematic risk that affects the returns on equities. This theory was created in 1976 by the economist. 9), a given finite number of factors is used as a formalization of systematic risks in the the two theories seem to be inherently disjoint. It is considered to be an alternative to the capital asset pricing model as a method to explain the returns of portfolios or assets. In finance, arbitrage pricing theory (apt) is a general theory of asset pricing that holds that the expected return of a financial asset can be modeled as a linear function of various factors or theoretical market indices.

Explain the arbitrage pricing theory (apt), describe its assumptions, and compare the apt to the capm. It is considered to be an alternative to the capital asset pricing model as a method to explain the returns of portfolios or assets. Sharpe, a simplified model of portfolio analysis management science, vol. It has been observed that the following factors tend to influence the price of the security under consideration. 1) why does arbitrage pricing theory (apt) matter?

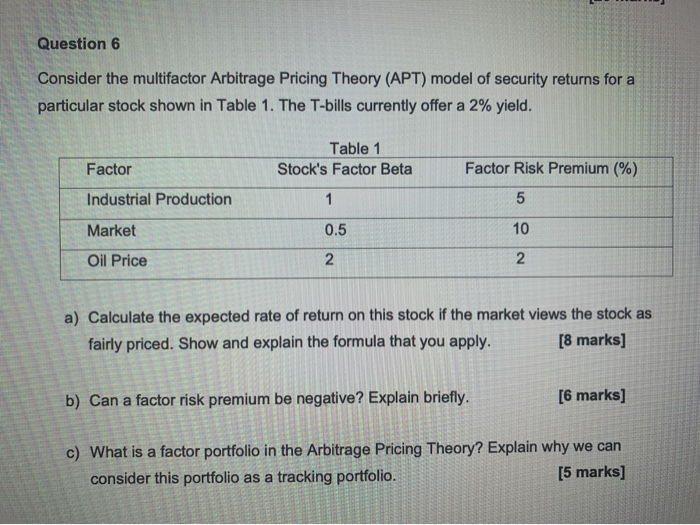

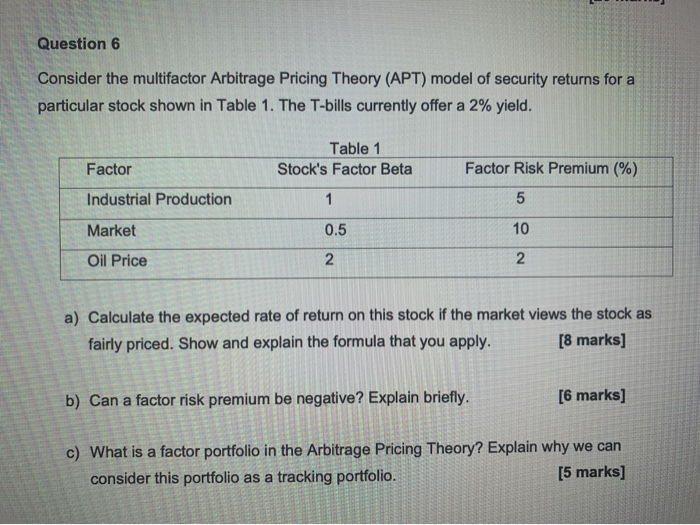

It is a useful tool for analyzing portfolios from. It is considered to be an alternative to the capital asset pricing model as a method to explain the returns of portfolios or assets. Consider the multifactor model apt with two factors. The general idea behind apt is that two things can explain the expected return on a financial asset: This theory was created in 1976 by the economist. However, we show that if the sequence of primitive returns is replaced by a sequence of returns on portfolios. Arbitrage pricing theory gur huberman and zhenyu wang federal reserve bank of new york staff reports, no. We start by describing arbitrage pricing theory (apt) and the assumptions on which the model is built. It makes different assumptions than the capm does. That is according to arbitrage if there are two assets which have same risk, theoretically their apt also holds that the correct price of an asset can be determined using the apt model derived expected rate. 2 the arbitrage pricing theory was first developed by ross (1976), and let us illustrate. Arbitrage pricing theory does not explicitly state the relevant macro economic factors; 1) why does arbitrage pricing theory (apt) matter?

In finance, the capital asset pricing model (capm) is a model used to determine a theoretically appropriate required rate of return of an asset. The second is the arbitrage pricing theory (apt), which we also cover in this module. The arbitrage pricing theory, or apt, is a model of pricing that is based on the concept that an asset can have its returns predicted. It is considered to be an alternative to the capital asset pricing model as a method to explain the returns of portfolios or assets. 1) why does arbitrage pricing theory (apt) matter?

This theory was created in 1976 by the economist. The model predicts that firm size affects average returns, so that, if two firms merge into a larger firm. The basic idea of the capital asset pricing theory is that there is a positive relation between 1 william f. Apt assumes that security returns are generated by a factor model but does not identify the factors. It is considered to be an alternative to the capital asset pricing model as a method to explain the returns of portfolios or assets. To do so, the relationship between the asset and its common risk factors must be analyzed. Then we explain how apt can be implemented. It is a useful tool for analyzing portfolios from. 1) why does arbitrage pricing theory (apt) matter? Sharpe, a simplified model of portfolio analysis management science, vol. It has been observed that the following factors tend to influence the price of the security under consideration. The general idea behind apt is that two things can explain the expected return on a financial asset: In finance, arbitrage pricing theory (apt) is a general theory of asset pricing that holds that the expected return of a financial asset can be modeled as a linear function of various factors or theoretical market indices.

2 the arbitrage pricing theory was first developed by ross (1976), and let us illustrate arbitrage pricing theory model of two factors. It is considered to be an alternative to the capital asset pricing model as a method to explain the returns of portfolios or assets.

The Basic Arbitrage Pricing Theory Model Of Two Factors: To do so, the relationship between the asset and its common risk factors must be analyzed.

Source: The Basic Arbitrage Pricing Theory Model Of Two Factors